- Nine practical ideas for 2026 Budget. Some

of these can be implemented in 2025. They cover a wide range of topics & take

us closer to Viksit Bharat 2047.

The 2025 India Budget has one big change

i.e. increase of income-tax exemption limit under the new tax regime to Rs 12

lakhs. The extent of increase was unexpected and caught media imagination.

Otherwise, it is more of tinkering as the Finance Minister (FM) effecting

changes based on feedback.

Come

budget time and industry/experts are skilled at asking for more expenditure but

few give ideas to increase government revenue.

Notwithstanding some good initiatives

like increasing number of medical seats by 10,000 here are some simple ideas

for Budget 2026.

1. People of India must

know which government, Centre or State, is responsible for what for e.g.

Agriculture is a state subject.

Every year, experts publish their ideas

on what the Central Budget must do for farmers. But, did you know that under the

Indian Constitution agriculture is a state subject.

Under the 7th Schedule of the Constitution, agriculture, health and water (includes irrigation and canals) come under the State List, whilst employment, education, land, labour, industry and power come under the Concurrent List. So also “‘land’ falls under the State List, while ‘acquisition and requisitioning of property’ comes under the Concurrent List, empowering the Centre as well as states to legislate on the matter.” Source Purchase

of paddy and wheat at MSP, declaration of MSP for others, funding fertilizer

subsidy-irrigation-agricultural research-building of dams-maintenance of buffer

stocks, agricultural lending and deciding on import/export policy is what the

Central government does.

Why is agriculture a state

subject?

The separation was first made by the

Government of India Act 1935 (passed by British Parliament). It was assumed by

the Constitution makers that agriculture was the responsibility of the states

hence they were given the right to tax agricultural income.

In 1950s, there was no fertilizer subsidy/Kisan Credit Cards etc. Declaration of minimum support price (MSP) was introduced in the 1960s during the Green Revolution. Today the Central government has a MSP program for wheat and rice, i.e. “heavily concentrated in Punjab and Haryana; and South eastern Andhra Pradesh”, decides import-export policy for agriculture products and provides financial support e.g. interest subvention on farmer loans and PM Kisan. Read Solution

to Farm Distress lies with State

Governments

State level politicians accept Central

initiatives on agriculture but say it is a State Subject when the status-quo is

proposed to be disturbed.

How can Central government be

responsible for something it does not have the corresponding authority?

It is time States agree moving

agriculture to the Concurrent List. But then the colonial Constitution would be

in danger!

We are in stuck in 1935. We accept Change only during a crisis like 1991 and forget the only thing constant in life is change.

The

Budget could have outlined a framework for the setting up of, on the pattern

GST Council, a Centre-States Council for Agriculture that would look at all

issues concerning agriculture in an integrated manner and prepare action

plan/budgets.

Supreme Court Judges need to be educated

too since any change in the 1950 Constitution invariably lands up in SC.

Go to end of article for Table that gives Summary of which government decides the farmer’s future.

India is run by the States. So we must focus on Budget Outcomes and Reforms by atleast the larger states

2. Promote Drip-Irrigation

Nationwide.

Drip irrigation in a farm near Bhuj in Kutch, Gujarat. 2018.

Drip irrigation in a farm near Bhuj in Kutch, Gujarat. 2018.

One of the serious problems is falling

ground water levels. This Indian Express

report

states, “While Punjab topped in groundwater depletion, Bihar was at number two with 188 (57.8 %) of its 325 wells recording a fall of varying degrees in water levels, followed by Uttar Pradesh (53.3 %), and Haryana (52.3 %).”

The

Budget could have a Scheme to promote drip-irrigation nationwide. It could make

expense by India Inc on capital expenditure permissible expenses under CSR.

In Kutch, Gujarat and water-starved Yuba

City (USA) I have seen the benefits of drip-irrigation.

Consumers

can help by changing food habits for e.g. shifting to millets and

traditional rice instead of basmati.

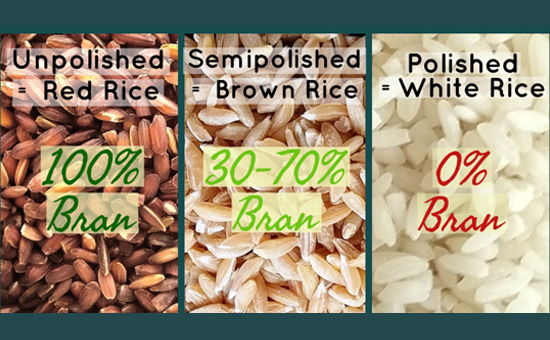

Devi Lakshmikutty of ‘Save the Rice Campaign’ wrote, “Paddy rice is not the culprit, we are the culprits, we polish the rice beyond recognition, we do not try out the range of traditional rice varieties with diverse nutritive profiles.” Source Traditional rice varieties of India

3. GOI must create a

Public Trust that allows Indians/India Inc to contribute to nation building for

e.g. weapons and ISRO.

Set up Bharat Suraksha Trust (BST) and Bharat

Pragati Trust (BPT).

BST

contributions could be used for the Border Villages Program and Purchase of

Weapons like S-400 and Rafale Jets.

Excellent school run by Indian Army near Kargil. 2016.

Excellent school run by Indian Army near Kargil. 2016.

The village program could involve schools, health, vocational training centres and tourism along border with Chinese-occupied Tibet and Pakistan. The trust could also employ residents of border villages for say planting trees. This will reduce migration because border residents are India’s first line of defence. Album Army

Goodwill School, Kargil and VCT

Drass, Ladakh

BPT contributions to be used for strategic technology missions that, if successful, make Indians proud for e.g. the Chandrayaan-2 mission.

How will the above work?

Create a separate website for projects where

public contributions are sought.

India Inc, resident Indians, Persons of

Indian origin can contribute in rupees to individual objectives only from a

bank account held in India. It is love for country and not tax breaks that must

stimulate contribution.

The technology backbone of website, its running

and citizen interface should be outsourced, a bit like how the passport office

is managed. Each project would have brief project details and a framework for

association.

Funds collected by both the trusts

should be used only for the purposes for which the money was raised. If people

see results, success or failure, money shall pour in. Conversely, if the

government used these funds elsewhere, the idea will become a non-performing

asset.

India Inc must realise that its prosperity is intertwined with the progress made by India and Bharat. Read How to get Innovative with CSR

4. Reduce Number of

Beneficiaries getting Free Food under National Food Security Act (NFSA)

The 2013 NFSA de-linked coverage under

Targeted Public Distribution System from erstwhile Poverty estimates to

Population estimates to cover 67% of population. Current cost app 2 lakh crs.

Poverty is falling but coverage same. In 2015,

the Shanta Kumar

Committee recommended bringing down the population coverage from 60% to 40% to “comfortably cover BPL families and some even above that.”

Support only those who are at the

bottom of the pyramid. Courts should not intervene since this is not a

matter of law. The number of beneficiaries and cost

can be reduced in 3 ways.

1.

Modi 1 had run a very good campaign urging people to give up subsidized LPG

cylinders. Run a similar campaign on free food grains.

2. Review/update basis of inclusion and exclusion parameters that were decided when the NFSA was passed in 2013. Use Technology to integrate databases. Follow parameters to remove bogus claimants

Exclude

government employees even if SC/ST. Evaluate if those who have benefitted from

subsequent government schemes like PM Kisan (cost Rs 66 lakh cr), transfer

schemes to women (cost atleast Rs 2 lakh cr) are still eligible.

Opposition will shed tear and States

shall resist! Mr Modi can use technology, facts and his famed oratory skills to

respond.

When we have the One Nation One Ration Card scheme, can India not

have an all India criteria in consultation with states?

3. Some states also give free food grains above the Centre’s allocation. A comparison of list of beneficiaries of Centre/ states might throw up anomalies. Read Centre

must review NFSA beneficiaries for Budget. Use Aadhar database, not 2011 Census

5. Sell Stake in Listed PSUs

to reduce fiscal deficit

Borrowings of Centre/States still higher than pre-pandemic levels. Courtesy HT Media Ltd.

Borrowings of Centre/States still higher than pre-pandemic levels. Courtesy HT Media Ltd.

Chief Economist Axis Bank N Mishra wrote

in The Times of India, “Prudent use of the more than Rs 40L cr valuation of government holdings in listed public-sector undertakings, can help GOI to achieve faster fiscal consolidation, reduce debt to GDP to much lower levels and provide a fiscal boost to growth, if necessary.”

More paper will increase depth of the

Indian stock markets and channelize savings too.

6. List State level PSUs

that must be sold or listed

The RBI

report on state finances stated said Punjab, Bihar, Kerala and West Bengal

have high levels of debt and need debt consolidation. Start by focusing on

these states. So while -

The decision to disinvest or list on the stock exchanges is that of the State governments the Budget could have set the ball rolling by tabling Niti Aayog Reports in Parliament which named state level PSU’s to be disinvested.

This could also become a parameter for the 16th Finance Commission

whilst determining grants to states.

7. Over-emphasis

on GST Collection not Ease of Doing Business

Inter-state GST Council Meetings focus

on the total GST collected rather than a complimentary objective of making GST

classifications simple for e.g. popcorn. Complications consume management time

and reduce ease of doing business.

With ever increasing state-level

freebies, cutting across party lines, I understand states desire to maximise

revenue. Strike a balance between both is suggested.

8. State level

Freebies-Women Allowance, Power Subsidy, Free bus women, Old Pension scheme

shall strain state finances.

Analysts are happy to note that Budget refers to a reduction in Centre’s debt to GDP ratio to 51% by around 2030. However, as per above table the consolidated debt for Centre and States is 87.5% for 2024-25 BE.

One, we must focus on consolidated debt

and not Centre debt alone. If this were to fall to 70-75% of GDP, it would

still be on the higher side and remain a source of vulnerability in the given

uncertain environment says the Business Standard editorial of 5/2/25. If states

borrow excessively to fund freebies, it shall increase inflation. Read

Why

State Govt borrowing must be in limits

We must remember

these words of I.G. Patel, RBI governor from 1977 to 1982, “It was already clear by 1986 that we were in an internal debt trap which would soon engulf us in an external debt trap. Rather than take any remedial action, we went merrily along, borrowing more and more at home and on shorter and shorter terms abroad.”

While Modi Sarkar has restored

macro-economic stability, the geopolitical environment is unstable. Excerpts

from late Dr MM Singh

budget speech of 1991, “The origins of the problem are directly traceable to large and persistent macro-economic imbalances and the low productivity of investment, in particular the poor rates of return on past investments. There has been an unsustainable increase in Government expenditure.” Read FREEBIES

are paid for by the common man-could lead to a 1991 type crisis for India

9. Promoting Tourism to Southeast Asia as an Instrument of India’s Foreign Policy

The Government of India and tourism

board of host country could run a joint advertising campaign in India to inform

Indians about places to visit in each country.

The campaign could promote countries

like Cambodia, Vietnam, Indonesia, Thailand and/or specific destinations for e.g.

Grand

Palace Complex in Bangkok, Mother

temple Bali, 326

foot Shwedagon Pakoda in Myanmar, Wats of

Bangkok, Hindu

Temples in Bangkok, Prambanan

Temple in Java, Jakarta’s National Museum is chock-full of Hindu artefacts, Todaji Monastery in Nara, Japan has a bronze statue of Vairochana Buddha and 26 feet statues of Lord Vishnu and Shiva in Japanese rendition., Yatra

to Mount Bromo and Indic

Heritage in Cambodia

Back home Bodh Gaya needs infrastructure change like Ayodhya. Nitish Kumar!

Indians voted for CHANGE

hence Modi. While good work has been done Yeah Dil Mange More

Also

read

1. IDEAS How India can Realize POTENTIAL

2. How to get

Innovative with CSR

3. Solution to Farm

Distress lies with State Governments

4. Centre

must review NFSA beneficiaries for Budget. Use Aadhar database, not 2011 Census

5. FREEBIES

are paid for by the common man-could lead to a 1991 type crisis for India

6. What

are the Central and State governments responsible for in India

7. Why

India needs a Masterclass in responsibility & accountability of each arm of

the Government

8. Promoting Tourism to Southeast Asia as an Instrument of India’s Foreign Policy

9. The

Long Road to the 1991 crisis

Summary of how & which government decides the farmer’s future

Responsibility Govt

|

Sr No

|

Work area

|

State

|

Central

|

|

1

|

Building of Irrigation Canals

|

Yes

|

No

|

|

2

|

Water Conservation

|

Yes

|

No

|

|

3

|

Promotion of Drip Irrigation

|

Yes

|

No

|

|

4

|

Providing Electricity

|

Yes

|

No

|

|

5

|

Introduction of new technology

|

Yes

|

Yes

|

|

6

|

Maintenance of Land Title Records

|

Yes

|

No

|

|

7

|

Land Leasing Law

|

Yes

|

No

|

|

8

|

Rules for Contract Farming

|

Yes

|

No

|

|

9

|

Markets in which farmer can sell

|

Yes

|

No

|

|

10

|

Levy of Mandi Taxes

|

Yes

|

No

|

|

11

|

Pricing of Seeds$

|

Market

|

Market

|

|

12

|

Pricing of Electricity

|

Yes

|

No

|

|

13

|

Minimum Support Price@

|

No

|

Yes

|

|

14

|

Pricing of Fertilisers / Subsidy

|

No

|

Yes

|

|

15

|

MSP wheat & rice procured by*

|

Yes

|

Yes

|

|

16

|

Maintenance of Buffer Food Stocks

|

No

|

Yes

|

|

17

|

International Trade Policy

|

No

|

Yes

|

|

18

|

Agricultural lending – Farm credit

|

No

|

Yes

|

*Food Corporation of India who work with

Centre and State agencies.

@ Note some States announce Bonus over and above the MSP.

$ One exception is cotton in Maharashtra

where price is state govt determined.