- Kerala govt says we are broke. This FAQ discusses the relationship between the Fiscal Deficit and inflation in India. It also touches upon state finances and the potential impact of not limiting government borrowing on the economy.

‘The Supreme Court’ (SC), meant to administer justice, is now beginning to subject the management of public finances to judicial review. This intervention raises questions about fiscal responsibility and its implications.

Utkarsh Anand wrote in

the Hindustan Times that the Kerala government filed a petition in the SC challenging “two letters issued by the issued by the Union finance ministry last year and certain amendments made to the Fiscal Responsibility and Budget Management Act in 2018 for “imposing a net borrowing ceiling (NBC) on the state by limiting borrowings from all sources, including open market borrowings.

The Centre, on its part, has argued that the financial edifice of the state has several cracks. It has given statistics to showing the revenue deficit in Kerala as percentage of gross state domestic product (GSDP) to be 3.17% for 2021-22, higher than the all-states average of 0.46%, and the fiscal deficit rate for Kerala to be 4.94% compared to an all-state average of 2.80%.”

In a surprising move, according to a March 12, 24 report in BarandBench, SC wants Centre to give Kerala a one-time package to bail

out state of financial crisis, subject to conditions. Interestingly, Kerala has

already received a revenue deficit grant of Rs 4,749 cr in 2023-24 and

Rs 13,174 crs in 2022-23! 1 Is suggesting a special bailout package

fair to states that follow fiscal prudence?

Does SC

know that, since 2016-17, states have

spent atleast 8% of their revenue receipts on subsidies? 1 And Brazil in the past had no limits on sub-national borrowing and it resulted in 1000% inflation.

At the outset, must state that I am a Chartered

Accountant, not an Economist.

This FAQ explains some economic terms, their importance

in the economy and why government borrowing needs to be within pre-determined

limits.

Let us start with Fiscal Deficit. (FD) Noted

economist Sajjid Chinoy

wrote about its importance and of debt in the Indian Express.

“Public debt to GDP is expected to increase from around 81 per cent of GDP to 83 per cent. That India’s consolidated deficit is too large for peace times and will continue to weigh adversely on debt dynamics if not brought down. This is because even as the Centre was committed to reducing its fiscal deficit from 6.4 per cent of GDP last year to 5.9 per cent in 2023-24, state deficits are on course to widening (from 2.8 per cent of GDP to 3.1 per cent or even wider), such that the consolidated fiscal deficit will stay close to 9 per cent of GDP.”

According to the RBI report on state budgets for 2022-23, “The Gross fiscal deficit (GFD) of states is budgeted to narrow to 3.4 per cent of gross domestic product (GDP) in 2022-23 from 4.1 per cent in 2020-21. While states’ debt is budgeted to ease to 29.5 per cent of GDP in 2022-23 as against 31.1 per cent in 2020-21, it is still higher than the 20 per cent recommended by the FRBM Review Committee, 2018, warranting prioritisation of debt consolidation.” Source

The key point is that when we look at FD it must be

the consolidated FD for Central and State governments. Both affect

macro-economic stability.

Q1. But, what is macro-economic

stability?

If today the Indian economy is considered to be doing

well, one of the principal reasons is macro-economic stability on various fronts including improved current

account deficit, robust banks and easing inflation pressure. Fortune India

If one compares current situation with UPA2,

macro-instability was then caused by fiscal expansion, high crude/inflation and

food support prices, 2013 run on the rupee, phone banking, banking sector problems and

over-leveraging etc.

The responsibility for maintaining

macro-economic stability in India lies with the Centre.

Bloomberg decision to include GOI bonds under the fully accessible route in its emerging market local currency government bond index is a result of India’s macroeconomic strength/stability. It gives a boost to the Indian debt market. JP Morgan’s included earlier. Since part of the budget deficit will be financed by foreign savings, it will reduce pressure on domestic savings to fund deficit which shall reduce interest cost.

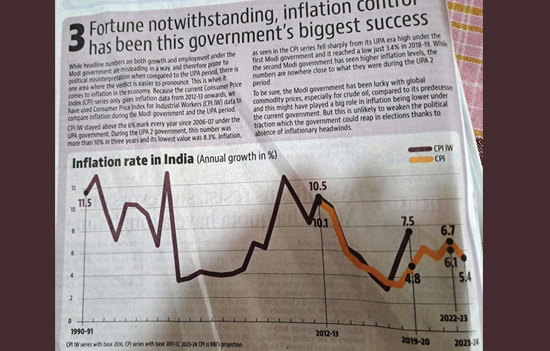

Courtesy Hindustan Times. Inflation rate was 10.1% in 2012-13, 6.1% in 2022-23. RBI forecast 2024-25 5.4%.

Courtesy Hindustan Times. Inflation rate was 10.1% in 2012-13, 6.1% in 2022-23. RBI forecast 2024-25 5.4%.

Q2.

What is Fiscal Responsibility and Budget Management

Act 2003?

The aim of this Act was to, “Provide for the responsibility of the Central Government to ensure intergenerational equity in fiscal management and long-term macro-economic stability.

It defines general Government debt, “as the sum total of the debt of the Central Government and the State Governments, excluding inter-Governmental liabilities.”

Under Section 4 (2) of the FRBM Act, “the Central Government shall prescribe the annual targets for reduction of fiscal deficit.”

Q3. What were the amendments made in

2018?

The amendment in the FRBM Act and Rules of April 2018

shifted the date for achieving the FD target of three per cent of GDP to the

end of 2020-21, and removed the targets for RD and ERD. Source The

15th Finance Commission has laid down the 3% target too.

An additional .5% FD is allowed to states for years

2023-24 and 2024-25 but is tied to power sector reforms. 1

Q4. What is Fiscal Deficit (FD)

It is excess of expenditure over revenue plus net

government borrowing during a financial year. In simple terms, it means excess

of government expenditure over income or government borrowing to finance

revenue deficit.

The FD of a country is expressed as a percentage of

GDP. To read more click Also read What is FD and more

FD targets exist for both the Central and State

governments, the definition being the same i.e. excess of expenditure over

revenue.

Q5. Why is managing the FD important?

A HDFC Bank note explains it simply, “The FD is keenly observed as it can impact various factors such as growth, stability of price, production costs, and inflation. If the fiscal deficit is large enough, it can also affect the country’s ratings.

For instance, when the government continues borrowing and stops printing currency notes, there is an upwards pressure on interest rates. Increased interest rates then result in increased production costs which lead to higher prices.”

Maharashtra has lovely beaches.

Maharashtra has lovely beaches.

Q6. What happens if FD goes too high?

Here are six possible impact points.

1. Crowding out. Financial resources are generally better utilised by the private sector than the government. If government borrows less there is more left for the private sector.

2. Cost of borrowing. Government borrowing rates are the risk free rates. Everyone else's rates are higher. If the fiscal deficit is high, bond yields are higher too.

This impacts borrowing cost for retail and corporate lenders. It increases cost of loans for housing loans and cost of operating in India. Costs are eventually borne by consumers. High interest cost discourages private investment.

3. Over time, the steadily high fiscal deficit creates a debt trap - debt to GDP keeps going up, and so the interest costs keep rising for the government, limiting productive spending.

4. Limited ability to counter economic shocks - when private sector is worried, government must add to aggregate demand by increasing spending. But if the deficit is already high it cannot.

5. High Inflation.

6. If the fiscal deficit is funded by foreign borrowing it will reduce foreign exchange reserves and might escalate into a foreign exchange crisis.

Backwaters of Kerala. Can Tourism generate adequate state revenue?

Backwaters of Kerala. Can Tourism generate adequate state revenue?

Q7. Is there a co-relation between FD and Inflation?

Simply put yes. Higher FD means more money in the market,

more money chasing fewer goods leads to inflation. Inflationary impact depends

on other factors too for e.g. is spending revenue or capital. Now let us look

at some two key numbers from 1980 to 2023.

T1 – A-Gross Fiscal Deficit as a % of GDP, B-Inflation

|

Year

|

A%

|

B%

|

|

1980-81

|

5.55

|

11.4

|

|

1986-87

|

8.13

|

8.7

|

|

1990-91

|

7.61

|

11.2

|

|

1997-98

|

5.66

|

7.0

|

|

2009-10

|

6.46

|

12.2

|

|

2010-11

|

4.80

|

10.5

|

|

2012-13

|

4.93

|

10.4

|

|

2014-15

|

4.1

|

6.2

|

|

2019-20

|

9.18

|

7.5

|

|

2020-21

|

6.72

|

5.9

|

|

2023-24 BE

|

5.9

|

5.4

|

Source RBI Handbook

on Statistics on Indian Economy

The fiscal deficit and inflation percentages began to

head southwards in 1986-87 and became a crisis in 1990-91. Inflation in 2009-10

was at a high of 12.2%. Ditto in 2012-13 when balance of payment came under

stress with import cover being (meaning foreign exchange reserves) equivalent

of seven months imports.

We might wish to recall what I.G. Patel, RBI governor

from 1977 to 1982, said in a famous speech (https://www.jstor.org/stable/41498726), “It was already clear by 1986 that we were in an internal debt trap which would soon engulf us in an external debt trap. Rather than take any remedial action, we went merrily along, borrowing more and more at home and on shorter and shorter terms abroad.”

While it is fine to argue for fiscal

responsibility, in crisis situations like Covid 19, war or recession higher

deficits are a necessity.

Q8. What about non-GST

state revenues?

Notwithstanding GST states have other

sources of income i.e. Sales tax/VAT/

excise duty on petroleum products and alcohol, property tax, water charges,

stamp duty, taxes on vehicles. If rates to consumers are rationalized states

gain.

Since GST is imposed at the point of consumption states

with large number of consumers gain for e.g. Delhi. Kerala looses out on two

counts, one it has a high NRI population and two a low level of

industrialization. States have to make

serious attempts to augment non-GST resources.

GST collections are also a function of

compliance. Hope GOI releases state wise GST revenue figures for the month and

cumulative for the year.

Q9. Should powers of the Central government be curtailed?

An article in ThePrint suggests that, “We should limit the powers of the Union government so dramatically that these resource allocation problems are solved at the level of states. The states would first meet their requirements and then pass on the necessary revenue to the Union government for its core functions like defence and external affairs. Or, at the least, have the Union stop spending on state subjects.”

This is not possible. States are not

independent countries. Inflation is a net result of the policies of the Central

and State governments. Any time, more in time of competitive populism to even

suggest that states use their own revenue first and then pass on the balance to

the Centre is a bad idea.

Yes, the Union must reduce spending

on state subjects but sometimes for e.g.

health schemes enable the Centre

to take certain policy measures as national development priorities and ensure

uniformity nationwide/get economies of scale.

India is a union of states with a federal structure. Elastic taxes for e.g. on income have to be with the Centre. If not there would be migration due to difference in tax rates like in USA. The Finance Commission balances and keeps the union together.

Q10. The Supreme Court's Intellectual Prowess

As the SC intervenes in a wide array of

matters, one cannot help but appreciate the intellectual acumen of its judges.

However, the question arises: Does the Court have the necessary expertise to

navigate the intricate realms of public finance management?

While the SC's concern for the financial well-being of states is commendable, its proposed solution raises questions about the separation of powers and the delicate balance between the judiciary, executive, and legislature. The management of public finances requires a nuanced understanding of economic principles, policy trade-offs, and long-term implications.

Star gazing in Ladakh is o/s.

Star gazing in Ladakh is o/s.

Q11. Some are comparing federalism in

India with say that of the U.S.

The Federal structure in India cannot be compared with

the U.S. or China which follow different governance structures and models.

Read India

is a union of states not a federation like USA

Live within your means is the deeper message.

Or be prepared to live with volatility and high inflation/interest rates.

Hope all Indians understand. Important Paper by Vidhi Centre for Legal Policy in 2014. The question was, ‘Central Government control over Sub-National Debt in India. To read click on PDF

In case of data errors please write

back. This article should not be republished without written permission of www.esamskriti.com

Reference

1. PRS Legislative

Research Paper-State of State Finances 2023-24.

Also read

1. Is co-operative federalism in India

breaking down

2. What is the true cost of electricity to states – just look at Tamil Nadu