- Know inflation rates in India from 2005 onwards. Because of higher food inflation, it is believed inflation is high even though it is under 5% today. People want inflation to be low irrespective of increase in commodity prices caused by geopolitical tensions.

Although Opposition politicians

repeatedly speak about high prices, the inflation numbers are not as high as

around 2013. Thus, inflation even if inflation is raised it is not such a big

issue in 2024 elections.

Public tend to forget that Covid19, the

Russia-Ukranine and Israel-Hamaz wars have put pressure on the supply-chain and

consequently prices. Yet, inflation is manageable.

The MINT carried an interesting article,

Will price rise

rock the boat at the ballot Unlike earlier, inflation is not alone India’s problem this time.

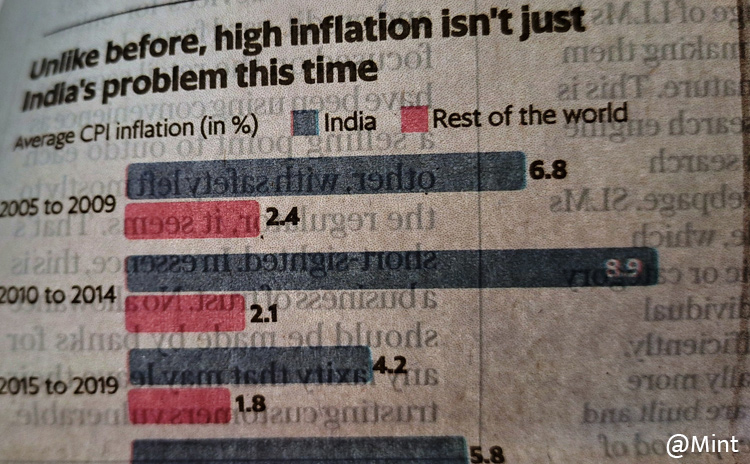

Average

CPI Inflation (in %)

|

Period

|

India

|

Rest of World

|

|

2005-2009

|

6.8

|

2.4

|

|

2010-2014

|

8.9

|

2.1

|

|

2015-2019

|

4.2

|

1.8

|

|

2020-2024

|

5.8

|

3.8

|

Above numbers as published chart.

Above numbers as published chart.

Even though the average inflation post

2015 is higher in India than the global average it is within manageable levels.

Yet, because of high prices of select food items (cereals, pulses), food

inflation is high which has led many to people that inflation is high.

Let us hope the Russia Ukraine war ends

soon. It shall help reduce commodity prices.

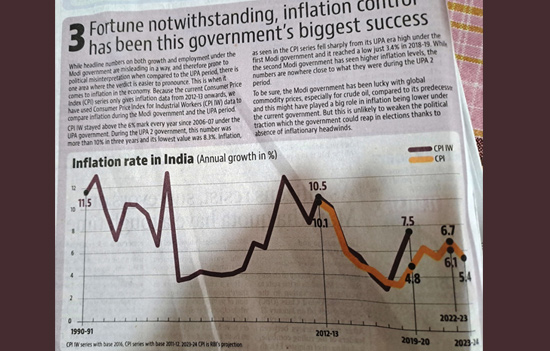

According to this Hindustan Times chart, the inflation rate was 10.1% in 2012-13,

6.1% in 2022-23 and expected to be (as per RBI projection) 5.4% in 2024-25.

People

in India want absolute inflation to be low irrespective of what is happening in

the world. That needs to change because an increase in oil prices or

disruptions due to war is beyond the control of any government, cutting across

parties.

People need to understand that inflation

is also a function of fiscal deficit. Simply put, inflation is more money

chasing less goods. So, quality of

government expenditure is key. Capital expenditure creates assets and enhances

incomes/productivity over time.

Also

read

1. Freebies

could damage hard won fiscal success